Life insurance is a very popular financial product for Indian customers. The only public sector life insurer in India LIC holds a major market share which is more than 65 percent along with its private counterparts run by major corporate houses of India like TATA, Bajaj, Kotak, Reliance and some of leading banks like HDFC, ICICI, SBI, PNB are quickly making ground for themselves.

Life is uncertain, hence many people perceiving the financial distress of their loved ones surviving after their demise, purchase a life insurance policy. In this current pandemic era people have been compelled to think again the seriousness and need of having a life insurance policy which can subside a bit the economic and emotional devastation of the family after the soul of the primary earning member departs to heavenly abode.

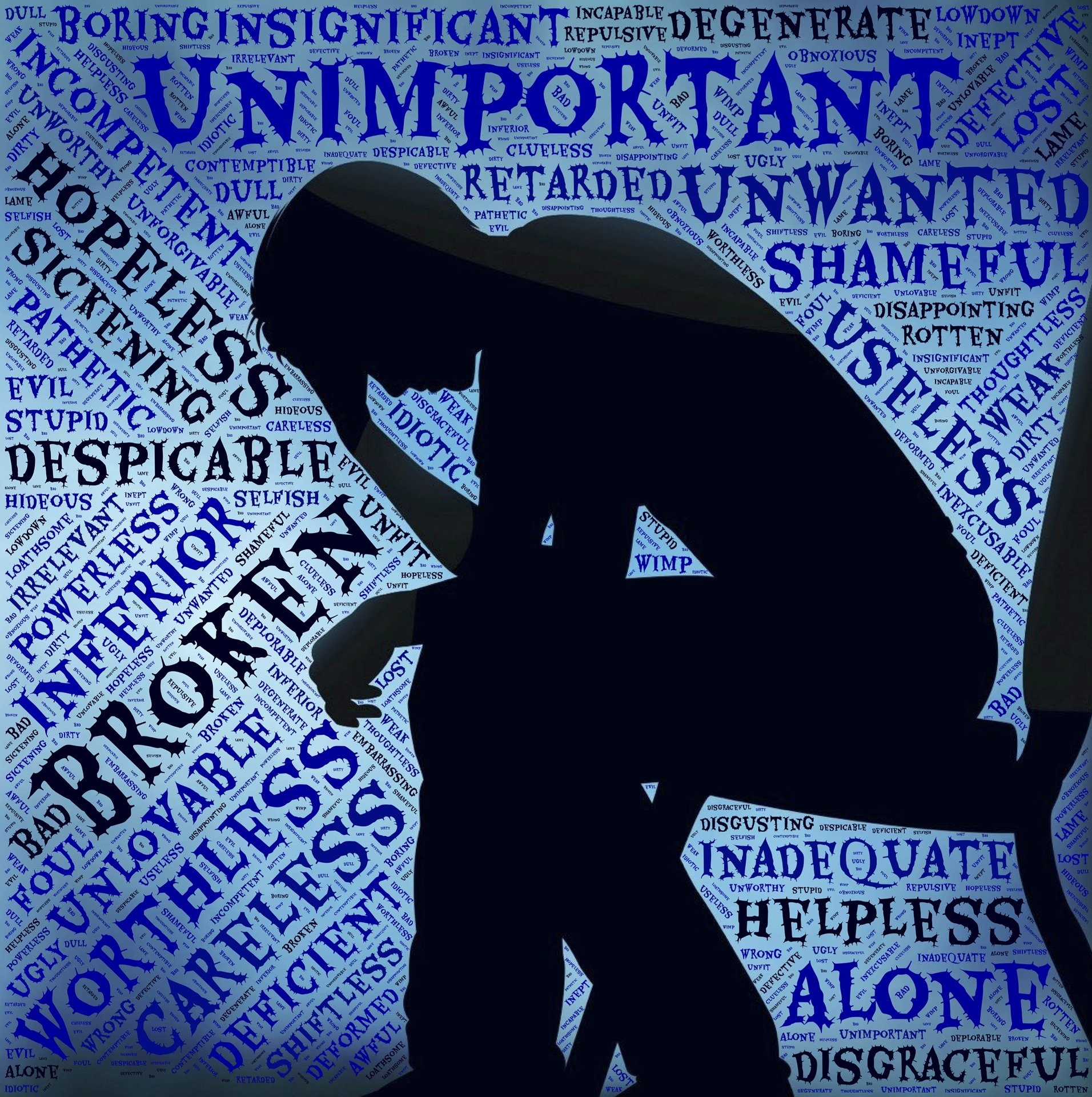

Life insurance is available in many forms in India and the products which provides a death benefit, generally provides the same due to death by any reason. In this article we will analyze such details for the benefit of the readers and try to clear the air on the question that does life insurance covers suicidal death in India?

There are various types of life insurance products available in the market like term insurance, endowment plans, saving and retirement plans, unit linked plans to name a few. As the primary essence of a life insurance product is the financial protection of the left behind family members who are the nominees under the policy after the untimely and unfortunate death of the prime earning member of the family, generally most of the products carry a death benefit element. In general, life insurers market their products saying it cover death due to any reason. But we often hear policyholders complain about the nuances and fine prints in the policy which they did not heed to initially but can make a big difference at the time of claim which is years after paying premiums on time, resulting in sheer disappointment and frustration often leading to legal cases.

Continue reading article ……

One of such question is the title of this article, for our readers we clear that yes life insurance products currently selling in the Indian market provides a cover for suicidal death after a waiting period, which in most of the cases is one year or twelve months. However we must note that coverage granted by any insurance policy varies from company to company and largely depends on the product construct and design. To know clearly what is covered under the policy and what is not everyone must refer to the policy copy provided the insurer, it is a legal document and must include all the policy terms, conditions, exclusions and warranties. Nothing is hidden in the policy copy and everything is stated therein. If anyone is unable to comprehend or decode any condition in the policy, they should immediately consult their agent, intermediary or insurance company directly for clarification to their peace of mind.

Knowing that suicidal death even after being a voluntary and certain event is covered nder the insurance policy, the question then arises that what if some fraud person takes a life insurance worth crores of rupees and then commits suicide or any other criminal minded person knowing that their family member has a life insurance of substantial amount murders the policyholder for money and tries to frame this as suicide. Also we know that in our nation due to pressure of debts and loans many commit suicide every year, they can easily take a life insurance policy and get the death benefit to relieve their family.

We will shed some light into these points which can create a morale hazard from suicidal death cover point of view and negated the spirit of an insurance cover. First we should note that life insurance like any other branch of insurance also has stringent underwriting processes followed.

A person is provided a life insurance policy considering any other life insurance policies he currently has and the amount of sum insured collectively under various policies under his name. At the proposal stage, the profile of the person is properly analyzed if he has some running policies with already high sum insured or asking a policy with substantial sum insured.

Continue reading article ……

The implementation of the waiting period of twelve months is nothing but one such measure to reduce the risk of writing bad risks by life insurer. A person with immediate need of money who is in pressure of debt to repay loan will not wait one year for the waiting period to be over and then get the death benefit to repay. The intention of the insurer to cover suicide is to relieve the family members of the victim in genuine cases and protect the nature of the policy to cover death by any reason.

In term life and other plans the nominee of the policyholder will get the death benefit sum insured mentioned on the face of the policy if the suicide is committed after expiration of 12 months of the policy inception. In unit linked policies the nominees receive the fund value or the NAV units subject to other terms and condition of the policy. This is generally true of all the life insurance products available in the market but there can be a variation in the terms and everyone should endeavor to read all policy terms to avoid any hidden surprises.