Underwriting year basis accounting usually helps in recovering the losses which occur on a specific policy during the period of treaty. The claims are recovered from the reinsurer who received the premium of that particular original policy this accounting method will be best suitable for the following classes of business.

Classes of Business Suitable for underwriting year accounting

Engineering / Liability

- Contractors all risk policy

- Erection All risk Policy

- Marine cum erection all risk policy ( Covering Delay in start-up D.S.U )

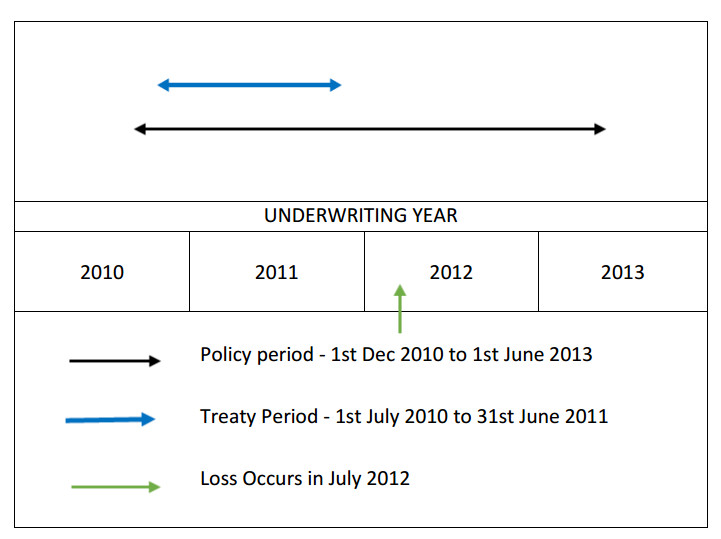

Engineering policies are normally extended for more than one year period, the engineering contracts will include a maintenance period which will extend the duration of cover, below is a chart will describe the underwriting year accounting (EXAMPLE)

As mentioned in the above chart the Engineering policy (CAR) incepts in the year 2010 for a period of 2 years and a maintenance period of 6 Months. Policy Starting from 1st Dec 2010 to 1st June 2013 and the treaty is form 1st July 2010 to 31st June 2011

The Loss occurs in July 2012

In an underwriting year basis the reinsurer for the year 2010 will be liable to pay for the losses, which occurred in July 2012 for the respective policy underwritten in the year 2010.

The primary insurance company and the reinsurers prefer to have this type of accounting due the nature of policies. Engineering Policies normally extended for more than 12 months duration to maximum of 64 to 92 Months based on the size of the project

The stipulated time of completion in an engineering project will not be fixed due to some of following reasons,

- Delay in start-up, also there is delay in mobilization of required materials.

- Additional Scope of Work from the existing contract.

- Change in Plans (designs) Natural perils like Rain, Storm, which slows down the contract work causing delay.

- Other perils such as local Govt, Third party liability as a lot of clearance is required before execution of a contract.

The Premium for engineering policies are usually paid in installments in many countries, as the contractor receives payment on running accounting bills for scope of works executed, hence the premium cession to the re-insurers for that specific policy usually takes time, hence it’s important for any insurance companies to have underwriting basis accounting with the treaty insurer for as maximum of their projects are for a duration of 5 years including maintenance period.

Another reason being claims usually occur during the mid or end of the project. In the initial stage engineering contracts will not have major works, their scope will be limited and the exposure to the assets or plant and machinery of the contractor will be very minimal.

As the contract progresses, the scope of work will increase where major structures are under construction. Progress in work will have a substantial exposure. Another reason for insurance companies to continue in underwriting year accounting (run off cover) as their experience in claims has occurred only during the end of the contract period.

The recovery of losses will be easier as the risk is being ceded to the re-insurer who accepts the premium in such cases insurance companies prefer to continue with the same reinsurer for a loss in a particular policy.

The reinsurer is also intimated accordingly and updated on periodic basis on the development of claims. This usually takes time as; the claim recovery is based on the following factors

- Estimation of Claim, including cost of repairs

- Repairs and reworking

- Dispute resolution between the parties (May occur due to delay in completion)

- Arbitration and final verdict

Premiums and claims are allocated with respect to the appropriate underwriting year and a preparation of reinsurance Bordeaux for each specific underwriting year.

Accounting Statements such as, to be prepared for specific underwriting years.

- Profit Commissions

- Premium reserves

- Claims Paid

- Ceding Commission

Clean Cut accounting System

In a clean cut accounting system the accounting system works on a portfolio transfer basis.

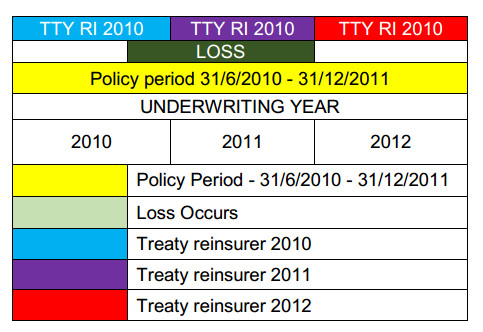

In the above chart the engineering policy gets incepted in year June 2010 and ends in Dec 2011 18 months policy including 3 Months maintenance period.

In a clean cut accounting the unexpired potion of the premium and outstanding losses (normally 90% to 100 %) are taken from 2010 Treaty re-insurer and transferred to 2011 Re-insurer (Portfolio in & Out)

Similarly the loss is settled only in the year 2012 and the unexpired portion of the premium and the outstanding claims are transferred to 2012 re-insurer and he becomes liable for payment of the losses.

The old treaty re-insurer will not be liable for the losses which occurred during their treaty period.

This type of accounting only works for Property, Energy classes which are annualized policies, in engineering classes of business policy period are up to five years, and most of their claims only occur at the end of the policy period.

Clean cut accounting will not be suitable as claim recovery will consume a lot of time and huge administrative work is required.

Since engineering claims by nature consist of Major repairs, rework and handing over, a lot of time is consumed in settling the losses and in a surplus treaty operating on claim transfer it will be difficult for the insurer to recover the losses from re-insurers as a lot of follow-up is required for the claims.